Sunday, March 18, 2012

Thursday, December 9, 2010

My First Short - by Lino R

[ Lino R is a SpikeTrade Member in Brazil. I met him during a SpikeTrade meeting in San Paulo where I encouraged everyone to learn to sell short. You do not have to be an active short-seller, but you should be comfortable with the technique. Earlier this week, Lino presented his first short at the latest Spiketrade meeting of the San Paulo group - Alex ]

Here's the 3 min. graphic of my first 2 IBOVESPA mini trades with basic comments.

a - These trades were in fact a way to test the complete trading process (e.g., tools, broker and legal requirements). I had an example of this when I exited the first trade (B1) due to an operational error. Then I re-entered (S2). The trade was exited on a tight stop (B2).

b - The basic signals for entering the trade were: (1) The market would probably close the early day gap up; (2) Shallow MACD; (3) Volume.

c - I could not include here the 15 min. graphic due to some (still unknown) technical reason.

Best regards

Lino R.

Here's the 3 min. graphic of my first 2 IBOVESPA mini trades with basic comments.

a - These trades were in fact a way to test the complete trading process (e.g., tools, broker and legal requirements). I had an example of this when I exited the first trade (B1) due to an operational error. Then I re-entered (S2). The trade was exited on a tight stop (B2).

b - The basic signals for entering the trade were: (1) The market would probably close the early day gap up; (2) Shallow MACD; (3) Volume.

c - I could not include here the 15 min. graphic due to some (still unknown) technical reason.

Best regards

Lino R.

Wednesday, June 16, 2010

Looking for SpikeTraders in Detroit

If you are a Spiker or SpikeTrade member located in the metro Detroit area of Michigan, USA, and would like to connect with other SpikeTrade members in your area, please send an email with your contact information to info@spiketrade.com. Your contact information will be given to local Member who is trying to organize a meeting.

Tuesday, October 20, 2009

Like the group & missed the Reunion - by Nikos Y, SpikeTrade Member

Kerry & Alex,

I would like to congratulate you for the SpikeTrade.com.

I wish I had subscribed earlier. It is very motivating being part of this group of like minded smart people who are all serious about trading. Indeed trading is a lonely activity and SpikeTrade membership helps me see how other serious traders think and act (and get from time to time some nice picks).

The deadline for submitting picks every Sunday is very interesting because we have to make our decision before the influence of the Asian markets close and without the feedback of Spikers. It has added more discipline and has structured a lot my homework. Now in my weekly preparation page, I have added a ratio of Spikers Long vs Short, a Member’s Ratio L/S and a ratio L/S of all the participants together with an added weight for the Spikers picks. It is interesting to observe the difference in sentiment between Spikers & Members or be alert when sentiment is overwhelmingly on one side (like last week for instance where it was 7/1 for longs).

I always wait for the publication of the weekly results and feel more satisfaction by being on the list of the winners than the money I make eventually from a winning spike trade in my account. The w/e of the spike reunion really felt weird. In the beginning I was not understanding why the list was not published, why the NH-NL was not online. Then I understood that you were having a great time and I felt sorry not being in NY.

Anyway, I have already booked the date for 2010.

Keep up the good work.

Best Regards,

Nikos

Monday, September 28, 2009

Wednesday, September 23, 2009

Shopping for Trouble: Is this the time to short retail stocks? - by Patricia L (Spiker)

When I saw this picture last week, my immediate response was that retailers are not going to have a good Christmas. This picture represents 12% of the world’s container ships that are sitting idle in the ocean off Singapore. The article said that the cost of transporting a 40 ft container of merchandise from China to the UK has fallen from £850 plus fuel charges last year to £180 this year.

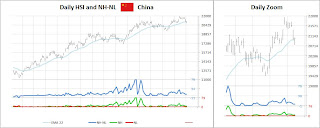

When I saw this picture last week, my immediate response was that retailers are not going to have a good Christmas. This picture represents 12% of the world’s container ships that are sitting idle in the ocean off Singapore. The article said that the cost of transporting a 40 ft container of merchandise from China to the UK has fallen from £850 plus fuel charges last year to £180 this year. This bearish scenario is confirmed by the decline of the Baltic dry index, described in several previous posts on this blog. The index peaked at 11,793 in May 2008, and bottomed at 663 in December 2008. The Baltic Dry Index is now at 2246. The green line represents the price movement of SPY.

This bearish scenario is confirmed by the decline of the Baltic dry index, described in several previous posts on this blog. The index peaked at 11,793 in May 2008, and bottomed at 663 in December 2008. The Baltic Dry Index is now at 2246. The green line represents the price movement of SPY. Would now be a good time to start shorting retail stocks? I have gathered this list of retail related stocks that the Spikers and SpikeTrade Members selected in the last year.

Cheers!

Cheers!

Patricia L

Sunday, September 20, 2009

Subscribe to:

Comments (Atom)